Markets Are At All-Time Highs, Should I Invest?

This commentary is an excerpt from our Q1 2021 Market Report, which also features world capital market performance along with the returns of stock and bond asset classes in the US and international markets during Q1 2021. Download the full report here.

Market Momentum

Market performance this past quarter has continued to build on the positive momentum of the last year. As of March 31st, 2021, the S&P 500 is up 56%, and global markets (as measured by MSCI All Country World) are up 55% over the past 12 months.

With such eye-popping returns over the past year, coming off the lows of the market declines from COVID-19, many clients are asking: “Should I invest given that markets are at all time highs?” Our answer is a resounding “yes!” Now is not only a great time to invest, but also an important time to embrace SWAG…

What is SWAG?

Growing up as a kid in South Florida in the 80’s and 90’s, I was a huge Miami Hurricanes fan. It was hard not to be (except for my brother, who was a Seminoles fan for some reason) having won 5 National Championships throughout my childhood, with such iconic players as Michael Irvin, Warren Sapp, Vinny Testaverde, and Edgerrin James to name a few. These players were so great, they had an intangible edge that their opponents evidently did not.

This intangible edge was known as SWAG, which Merriam Webster defines as “bold self-confidence”. It was so apparent, the Hurricanes (“the U”) have been credited with inventing SWAG!

Similarly, we at SAM believe in applying a SWAG mentality to gain an intangible edge and create a life of abundance. In this case we define SWAG as:

S – Sustainable

W – Wealth

A – All

G – Generations

A key ingredient to embodying SWAG is to take a multi-generational approach to wealth advisory. Instead of getting caught up in the day-to-day approach, the secret is to adopt a decades rather than days mindset focused on the financial sustainability of the generations that will follow you.

Harnessed with the right mindset, we can then look to another important variable of SWAG:

Putting Current Market Activity Into Perspective

“Markets are at all-time highs” sounds like an amazing accomplishment; but to a person who has excess cash (currently earning close to 0%, or -2-3% after inflation) it may seem to be a daunting time to invest that cash.

However, if we put current market activity into historical perspective, an important question arises: “how often has this taken place, and what can be learned from previous market highs?”

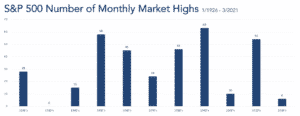

The earliest monthly data we can find on the S&P 500 takes us back to the 1920s, which shows that “record highs” are much more commonplace than one might initially expect:

Since the 1920s, the S&P 500 has reached a total of 349 monthly all-time highs, which means almost 31% of the months over the past century have recorded new all-time highs; a new all-time high every 3-4 months!

For the continued skeptic who isn’t yet on the SWAG wagon, the next retort might be: “are you proposing that it would have been advisable to invest during any of these all-time market highs?

The historical facts suggest, again, yes. After 1-year, 81% of the time, the market was higher, with an average return of almost 14%. Those who had adopted longer-term thinking increased their odds to 85%, with an average return of approximately 10% a year, or 61% total return over 5 years.

Should I Invest? Embrace SWAG!

Whether you seek emotional bliss, physical health or financial freedom, creating a life of abundance takes SWAG! It’s that humble confidence to block out the short-term noise, concentrate on facts over fear, and think multi-generationally that will ultimately reap the greater rewards.

Markets have again reached an all-time high, but history shows this is more commonplace than one may think, and the odds tell us new record highs will continue to drive the market in future years.

So, should one invest with markets at all time highs? If your goal is to create SWAG, sustainable wealth for all generations, then we say yes!

This commentary is an excerpt from our Q1 2021 Market Report, which also features world capital market performance along with the returns of stock and bond asset classes in the US and international markets during Q1 2021. Sign up here to receive our quarterly market commentaries delivered right to your inbox.

Get the Latest Wealth Insights, Delivered.

Further Reading

Stamina & Endurance

Jonathan Satovsky Interviews Rabbi Simon Jacobson

Always on the run