The Fundamentals of Donor-Advised Funds

As we head into the season of giving and approach the end of 2022, it’s the perfect time to talk about what we consider to be one of the best ways to make charitable contributions—Donor-Advised Funds.

A Donor-Advised Fund (“DAF”) is an irrevocable charitable giving account that allows clients to separate the timing of a tax deduction from charitable giving. One can contribute cash, stock, and some non-publicly traded assets like real estate, private company stock, and restricted stock, among others. The tax deduction will apply during the same year in which a contribution is made, but the assets can be distributed to charities effectively at any time.

The account can be established whenever one is ready through sponsor organizations such as major fund companies, community foundations, universities, and individual charities. We prefer working with Fidelity Charitable when establishing DAFs for clients. Minimum required investments vary—some start as low as $5,000 such as Fidelity, while others require a $25,000 initial contribution. A trusted advisor can help navigate interested parties to the right fund, as well as assist in managing the assets therein.

When a Donor-Advised Fund is utilized there are many benefits for both the donor and the donee:

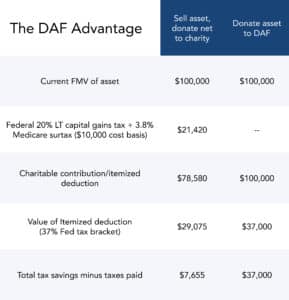

1. Tax Benefits: Clients are encouraged to use long-term appreciated securities when contributing to a DAF. This results in receiving a tax deduction for the full fair market value of the securities and not having to pay capital gains tax on those securities (see graphic below). We recommend that when using long-term appreciated securities, donors purchase back the same securities contributed to the DAF to lock in a higher basis, and potentially improve their tax situation in the future.

These accounts also may help reduce tax burdens after a windfall situation, such as selling a business, or experiencing strong market returns. When a charitable contribution is made to the fund an immediate tax deduction is available, thus reducing tax liability in the year when it is needed most.

An important rule to remember is that the deduction for long-term appreciated securities is limited to 30% of one’s adjusted gross income (AGI). Unused deductions can carry over for five years, however, if a large donation is made exceeding or nearing the AGI limit, consider consulting a tax professional beforehand.

2. Growing Contributions: Once a contribution is made, the funds can be invested in a diversified investment pool with a range of different risk mandates. This means that contributions can potentially grow over time and result in additional support for donees. For accounts over $250k in value, SAM can be named as advisor to help manage future growth consistent with clients’ giving goals.

3. Operational Efficiency: No one enjoys scouring their bank and credit statements for the many donations given throughout the year. Come tax filing time, clients will only need one tax receipt from the DAF.

4. Creating a Legacy: An account holder can name any individual as their successor after their passing to control their DAF. Charitable organizations can also be named to receive the funds in the account after an account holder has passed.

At SAM, we often speak about seeking Wisdom, Wealth, and Wellness. The most important, Wellness, can be amplified by providing support to others and contributing to one’s community. In fact, research from Science and the University of British Columbia links giving to causes one cares about to increased happiness and life satisfaction. So please consider speaking to your SAM advisor about establishing a Donor-Advised Fund ASAP (as the deadline for gifts of long-term appreciated securities is fast approaching), and in the meantime, be well.

Get the Latest Wealth Insights, Delivered.

Disclosures

This blog post is not intended to be, nor should it be construed or used as, an offer to sell, or a solicitation or offer to buy any securities or interests in any strategy offered by Satovsky Asset Management, LLC (“SAM”). SAM is a registered investment advisor with the Securities and Exchange Commission – for more information see www.adviserinfo.sec.gov. Please remember that different types of investments involve varying degrees of risk, and that past performance is not indicative of future results. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the strategies recommended or undertaken by SAM) will be profitable. Market index information shown herein is included to show relative market performance for the periods indicated and not as standards of comparison. The market volatility, liquidity and other characteristics of SAM’s portfolio composition are materially different from the securities listed on public market indices. Market index information was compiled from sources that SAM believes to be reliable. No representation of guarantee is made hereby with respect of the accuracy or completeness or such data. Opinions are as of date of video and are subject to change. A copy of SAM’s current written disclosure statement discussing our advisory services and fees continues to remain available for your review upon request. SAM undertakes no duty to update information presented herein.

Further Reading

Jonathan Satovsky Interviews Rabbi Simon Jacobson

Always on the run

Learning something new