The market continued its fantastic run in the second quarter of 2024. But what I should really say is that the S&P 500 continued its fantastic run. The S&P rose another 4.3% in the second quarter, bringing year-to-date gains to 15.3%. Other markets weren’t as good. US small cap stocks1 were down 3.3% in the second quarter, and International markets were down less than 1% in the quarter, bringing year-to-date performance to up just over 5%.

Why the divergence? There are always lots of reasons, but the biggest is AI. The market generally believes that the largest companies in the world are the ones who will benefit the most, and excitement around AI is pushing the highest market cap companies to new heights. Within the S&P 500, companies related to the theme gained 14.7% in market value this past quarter, whereas the rest lost 1.2%.2

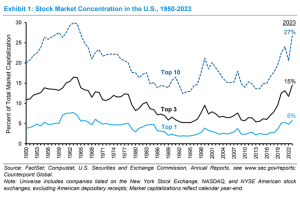

Remember, the S&P 500 is made up of approximately the largest 500 stocks in the US.3 We spoke in last year’s fourth quarter letter of the “magnificent 7”4 driving the performance of the S&P 500. In the second quarter, that narrowed even further.

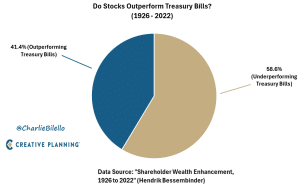

It is true that normally, much of the market’s performance is centered around a minority of stocks. As you can see from the chart5, nearly 60 percent of stocks underperform treasuries, illustrating the benefits of diversification.

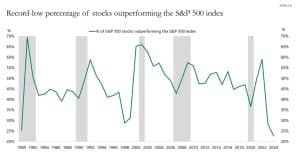

Nevertheless, 2024 has been extreme by historical standards. The chart below shows how a record-low number of stocks are outperforming the index – under 25%. What that means is that market concentration is at historical highs.6

Nvidia alone accounted for 43% of the S&P 500’s second quarter gain and nearly a third (31%) of the year-to-date increase.7 Apple contributed 31% of the second quarter’s gain. This means that three quarters of the S&P’s Q2 growth came from just two stocks.8

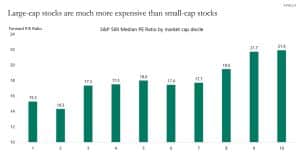

What’s the conclusion from all that? There are a few, but the biggest is that despite the market being “high,” there are still reasonably priced stocks. Here’s one chart which shows the valuation of small caps vs. large caps:9

Historically, small caps traded at a premium valuation, because there was more potential for growth. Today that’s reversed. Satovsky has exposure to small caps in part for that reason.

Berkshire

Berkshire Hathaway held its first annual meeting since Charlie Munger’s passing. Berkshire put together a lovely tribute to Munger, calling him the architect of Berkshire. In his memory, I thought I’d pass along a few of his more famous quips that he said over the years10:

“If you mix the mathematics of the chain letter or the Ponzi scheme with some legitimate development like the development of the internet, you are mixing something which is wretched or irrational or has bad consequences with something that has very good consequences. But you know, if you mix raisins with turds, they’re still turds.” (2000)

“What I needed to get ahead was to compete against idiots. And luckily there’s a large supply.” (2014)

“A man who jumps out of a building is OK until he hits the ground.” (2023, on government deficits)

One-Day Settlement

One administrative note—on May 28, stock and ETF settlement went from two days to one day, which means that the cash gets credited into accounts one day sooner. If you ever need funds that require sales of stocks and ETFs, you just saved a day.

Roaring Kitty Returns

I could put this story in the “interesting stories” section, but I think it’s too important for that. “Roaring Kitty” (aka, Keith Gill), the meme stock star, posted this on May 12.11

Roaring Kitty was one of the boosters on the Reddit subgroup WallStreetBets that started the meme stock craze years ago. But this was his first post since 2021. The new posts caused GameStop stock to rally 180% over two days, adding approximately $10 billion in market cap to the company. That’s not a typo: $10 billion for a picture (and video). Market participants can have disagreements about stocks—that’s fine. But $10 billion on sitting forward in a chair? Meanwhile, since he last posted his bullish thesis on the stock, GameStop the company has been close to a trainwreck. Revenues and earnings are plummeting. To its credit, GameStop took advantage of the price increase and sold more stock to the public. Perhaps they know best when their stock is overvalued? I’m sure it doesn’t need repeating, but don’t fall for crazy stories like that—ever. The stock is down by 50% since the peak a month ago.

Interesting stories from the quarter

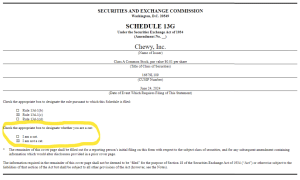

Speaking of Roaring Kitty, he does have a sense of humor. Later in the quarter, he filed a 13G on Chewy, saying he owned more than 6.6% of the stock.12 I’m guessing few to none of you have read as many SEC filings as I have; they are generally standard, boring fare, which requires certain information to be disclosed. But it doesn’t prevent you from disclosing additional information, which he decided to do.13

Hilarious! No, he is not a cat.

Cryptocurrency is the gift that keeps on giving (for this segment of the newsletter, at least).14 Why would anyone want this?

Werewolf Coin, a cryptocurrency that can only be used during the full moon, publicly launched today.

A project by an anonymous artist, Werewolf Coin can be transferred for 24 hours before each full moon and for 24 hours after each full moon. Astronomically, a full moon refers to the moment when the Moon is exactly 180 degrees away from the Sun.

No thanks!

Last year, when First Republic Bank went bankrupt, a bunch of other banks that have “First” or “Republic” in their names got nervous that they would face a run on the bank because of mistaken identity. One bank’s stock, Republic First, declined 40% in the month that First Republic went bankrupt. In response, the CEO wrote an open letter saying, “We are NOT First Republic Bank.” You would think that this kind of confusion wouldn’t happen with efficient markets, but it does. Well, a year later, Republic First has gone bankrupt, with its assets sold to another bank. Maybe the market is more efficient than we think? Truthfully, I doubt that it went bankrupt due to a run from the naming issue, but it sure is a coincidence!

Finally, last quarter I told you that my younger son needed to figure out which college to attend. He ended up choosing Harvard. I know he is grateful for the opportunity (as am I), and I’m 100% confident he’s going to do great there. Well deserved, Zach!

Thanks to all of you for your trust in our partnership.

Avi and the Satovsky Asset Management team