Keep It Simple | Wisdom, Wealth, and Wellness

Keep It Simple | Wisdom, Wealth, and Wellness

When someone receives a large sum of money unexpectedly, sudden wealth syndrome can take place, leading to anxiety, isolation, and poor decision-making. If this happens to you, try to keep things simple and take your time to find an advisor who treats you and your legacy with the care you deserve. Remember, simplicity safeguards your newfound wealth and well-being.

“A Couple Won the Powerball. Investing It Turned Into Tragedy.”

This was a Wall Street Journal article (headline) in July of 2024. The couple was flown by a private jet to a major financial institution’s headquarters to talk about what to do and it did not work out very well. They got put into extraordinarily high-fee, highly complex products that were told to be the ideal situation for people like them.

Keep it simple.

I mean, listen, the iPhone has no buttons, and people said, “You can’t do that. You need all sorts of keypads and buttons. You know people aren’t gonna be able to figure out how to use it.” Pretty sure people figured it out.

Simple is better than complex.

Sudden wealth syndrome is a real thing.

If you get money in a really quick period of time, keep it simple. The KISS principle is what I was told early in my professional life. So keep it simple. Ideally, look for an independent fiduciary. And I understand it’s complicated because people get seduced by the big names. The big names are perceived to be safe—they’re safe because you can sue them and collect some money after they may not treat you so well. But look for someone who’s going to treat you like family and take care of you the way you would want to be cared for. Think about (your wealth) over a long period of time, you’re building lifetime relationships.

For those of you in the advisory community, do the right thing. Building a reputation takes a lifetime and five minutes to screw it up, so don’t try to make a quick buck on your own path to Wisdom, Wealth, and Wellness.

Have a great day.

Get the Latest Wealth Insights, Delivered.

Disclosures

This blog post is not intended to be, nor should it be construed or used as, an offer to sell, or a solicitation or offer to buy any securities or interests in any strategy offered by Satovsky Asset Management, LLC (“SAM”). SAM is a registered investment advisor with the Securities and Exchange Commission – for more information see www.adviserinfo.sec.gov. Please remember that different types of investments involve varying degrees of risk, and that past performance is not indicative of future results. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the strategies recommended or undertaken by SAM) will be profitable. Market index information shown herein is included to show relative market performance for the periods indicated and not as standards of comparison. The market volatility, liquidity and other characteristics of SAM’s portfolio composition are materially different from the securities listed on public market indices. Market index information was compiled from sources that SAM believes to be reliable. No representation of guarantee is made hereby with respect of the accuracy or completeness or such data. Opinions are as of date of video and are subject to change. A copy of SAM’s current written disclosure statement discussing our advisory services and fees continues to remain available for your review upon request. SAM undertakes no duty to update information presented herein.

Further Reading

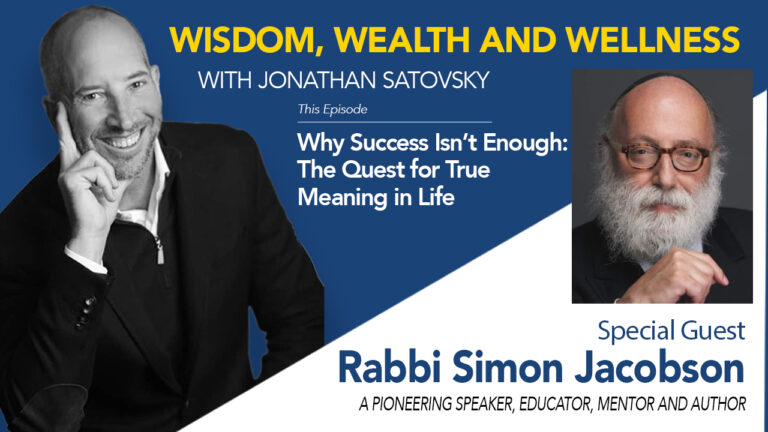

Jonathan Satovsky Interviews Rabbi Simon Jacobson

Always on the run

Learning something new