Investing Is Simple but Not Easy

Investing Is Simple but Not Easy1

The market continued its fantastic run in the third quarter of 2024. The S&P rose another 5.9% in the third quarter, bringing year-to-date gains to 22.1%. For the first time this year, though, it was not US large cap growth that led the way. US small cap stocks2 were up 9.3% in the third quarter, and international markets3 were up 7.7% in the quarter.

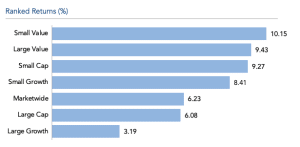

Indeed, in the US, we finally saw a complete reversal in market leadership this quarter. As you can see from the chart below4, small value, a long underperformer, led the way in the quarter, with large cap growth lagging by 600 basis points. Will this reversal continue? We discussed this in previous letters; historically, there is some mean reversion when one asset class underperforms for a long period of time. Is this the beginning? We don’t know. But we are positioned to capitalize if it does.

The Election

If there is one thing that consistently comes up in client calls it is the election. In general, when I speak with Democrats, they warn of dire consequences if Trump is elected, and when I speak with Republicans, they say the same thing about a Harris victory. While there are clearly impacts other than on markets, the data for markets is much less impactful. As you can see from the chart (sourced from Dimensional), markets have done well regardless of which party holds the presidency.

The same holds true regardless of whether Congress was controlled by Democrats, Republicans or split.5

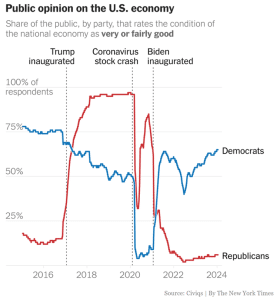

Why do people get so nervous around elections? This chart6, which we first shared with you in our first quarter letter this year, highlights one reason—many people let their politics color their view of what is happening in the economy. The chart below shows how Democrats and Republicans have viewed the economy over time. Note that in 2016, Republicans’ views of the economy immediately changed to the positive once Trump was elected—even before he could implement anything to help the economy! And when Biden was inaugurated, Republican views on the economy plummeted, again, even before Biden did anything. Unfortunately, Democrats are only slightly better, and reacted close to the mirror image of Republicans. The reality is that the economy grew and the market rose during all three presidencies.

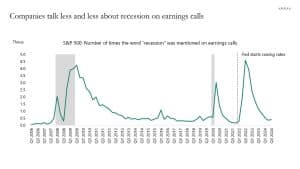

The reality now is that the economy looks good. Inflation is coming down (now under 3%), unemployment is still low (just over 4%), and job openings, while having declined from peak, are still high relative to history. Many other data series also look good. For example, I saw this series7, which shows how often companies talk about recessions on earnings calls; it is back down to near lows.

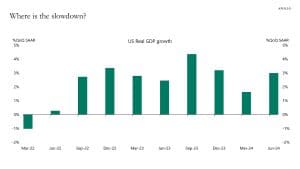

In fact, the most important economic indicator—real GDP growth—looks just fine.8

The conclusion here is to keep emotions aside and stay with your plan. We know, as Warren Buffett said, “investing is simple but not easy.” We are here to help you through your financial journey.

Private Debt

Private debt has been exploding over the last few years as people have been chasing higher yields. The general concept is that private debt can be better for companies despite the higher cost because:

1. They can close more quickly in a private transaction.

2. There is a higher likelihood of closing the deal and getting the money. In a public deal, the investment bank can only promise best efforts to get a deal sold to the market.

3. Only one party holds the debt so if there is an issue, it’s easier to negotiate a workaround.

It’s also pitched as better for the financial system, because in contrast to a bank which gets funding from deposits (which, as we’ve seen a few times over the last couple of years, can leave the bank quickly), private debt gets funding from long-term investors in locked-up vehicles.

I have been more skeptical about private debt, and so far, have decided not to allocate capital there. Private debt, despite its proponents’ grandiose claims, is predominantly linked to private equity transactions. I recently read an article by Matt Levine in which he delineates just how much leverage can seep into the private equity world. Here were the essentials:9

1. If there’s a company, a private equity fund can buy it, putting up some of its own money (the equity) and borrowing the rest, secured by the assets of the company.

2. The private credit fund that made the loan in Step 1 can put up some of its own money and borrow the rest from a bank to fund that loan.

3. The private equity fund buying the company in Step 1 can temporarily borrow the money it uses to write the equity check (a “subscription line”), secured by the commitments of its investors (its limited partners) to eventually put up the money.

4. After buying the company, the private equity fund can take out a margin loan, secured by its equity stake in the company.

Or it can take out a net asset value loan, secured by its equity stakes in a whole portfolio of companies it owns.

5. Also, the company can borrow more money to pay dividends to the private equity fund.

6. The limited partners can sell their stakes in the private equity fund to a secondaries fund, which can borrow some of the money to buy them.

7. The general partners (sponsors) of the private equity fund can borrow money, “secured by management fees and carried interest income.”

8. Or other funds can borrow money to buy the general partners’ stakes in their firms.

As long as things are going well with the underlying company, everything is fine. We’ll see when we hit the next recession how well these funds hold up. Some inevitably will, but I have my doubts about the industry as a whole.

Leveraged ETFs

Another hot investment idea10 is leveraged ETFs. The idea is that the ETFs buy futures to give you a multiple of the return on some underlying index or stock.

The problem is in the structure—these ETFs seek to give the investor a multiple of the daily return of the index or stock. So, when the stock rises, they must increase their derivatives exposure by buying more. When the stock declines, they need to sell exposure. This is an inverted strategy, where the ETF buys high and sells low! It works only if the index or stock goes up in straight line. If there is volatility, it’s toast. I recently read11 about an extreme example of this: GraniteShares 3x Long MicroStrategy Daily ETP, whose aim was to give the investor three times the return of MicroStrategy stock. As of the beginning of September, MicroStrategy stock was up more than 100% this year, while the ETP has dropped nearly 82%! So, while it did a good job of giving you a 3x return on a daily basis, it did a terrible job on a year-to-date basis.

Interesting Stories from the Quarter

We have written a few times on ESG. Our general view is that, while there are good intentions, the data are unavailable or unreliable, the definitions malleable and inconsistent, and the incentives faulty. Recently, I read an article by researchers at Berkeley and Stanford12 which stated that:

1. 63% of firms in the S&P 500 include an ESG component in executive compensation

2. A “vast majority” include it as part of the annual incentive (not the long-term incentive) plan

3. Only 2% of firms report the executives missing the ESG targets

For comparison, the researchers noted that executives miss their financial targets 22% of the time; still a minority but at a rate 10x as large as those that miss ESG targets. Is it because these executives do a great job improving on ESG or related to governance issues? The researchers found:

Meeting ESG-based targets is not associated with improvements in ESG scores and that the presence of ESG-linked compensation is associated with more opposition in say-on-pay votes provides support for the weak governance theory over the exceptional performance theory.

I tried to avoid saying anything on crypto, but I couldn’t help it on this one.13 In August, the SEC filed a complaint against Nader Al-Naji, the founder of BitClout. BitClout raised $257mm from investors to start a web and application-based social media platform. BTCLT would be the native token on the project. Al-Naji touted BitClout as “like Bitcoin” because “it was a fully open-source project with no company behind it, just coins and code.” One of the things that got people excited about the project was that the price of BTCLT was to double with every million coins sold on the platform.14

What was interesting to me here was that investors supposedly asked how he would use the money to build out the platform. His response was that he couldn’t promise to do so. Without explicitly saying why, the implicit answer was that doing so would make BitClout a security with all its associated regulations. So instead, he made no promises to spend the money on the platform and ended up pocketing the money. As Levine concludes:

And so, if you were raising money for a crypto project in 2021, you could tell investors “I don’t control this project, it’s totally decentralized, none of the money will be spent on developing the project, wink wink.” And investors would say “of course, wink wink, that’s how you avoid registration as a security.” And then you could just take the money! And be like “what, I told you I wouldn’t spend it on developing the protocol, and I didn’t.”

Keep it simple.

Thanks to all of you for your trust in our partnership.

Avi and the Satovsky team

Get the Latest Wealth Insights, Delivered.

Disclosures

This blog post is not intended to be, nor should it be construed or used as, an offer to sell, or a solicitation or offer to buy any securities or interests in any strategy offered by Satovsky Asset Management, LLC (“SAM”). SAM is a registered investment advisor with the Securities and Exchange Commission – for more information see www.adviserinfo.sec.gov. Please remember that different types of investments involve varying degrees of risk, and that past performance is not indicative of future results. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the strategies recommended or undertaken by SAM) will be profitable. Market index information shown herein is included to show relative market performance for the periods indicated and not as standards of comparison. The market volatility, liquidity and other characteristics of SAM’s portfolio composition are materially different from the securities listed on public market indices. Market index information was compiled from sources that SAM believes to be reliable. No representation of guarantee is made hereby with respect of the accuracy or completeness or such data. Opinions are as of date of video and are subject to change. A copy of SAM’s current written disclosure statement discussing our advisory services and fees continues to remain available for your review upon request. SAM undertakes no duty to update information presented herein.

Further Reading

Jonathan Satovsky Interviews Rabbi Simon Jacobson

Always on the run

Learning something new