Happy new year to you and your families.

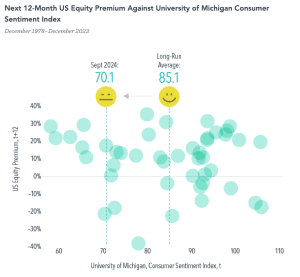

Despite the second strong year in a row for markets, some people are feeling pessimistic. As of September 30, 2024, the University of Michigan’s Consumer Sentiment Index1 sat at 70.1, much lower than its long-run average of 85.1.2 Before we get into what this might mean for markets (spoiler alert—not much), let’s first talk about why the reading might be so low.

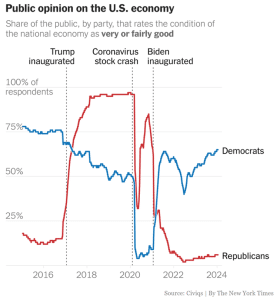

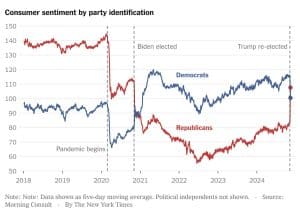

In last quarter’s letter, we showed this chart,3 which we used to postulate why people get so nervous around elections—many people let their politics color their view of what is happening in the economy. Despite the wild gyrations in sentiment, the economy grew, and the market rose during all three presidencies.

The chart4 below is a slightly different data set—consumer sentiment vs. people’s opinions of the US economy—but it shows a similar effect extended post-election. Note that post Trump’s re-election, Republican sentiment jumped considerably, while Democrats’ sentiment immediately plummeted. Remember, markets have risen regardless of which party was in power, including which party controls the Congress.

To go back to the Consumer Sentiment Index, for all of its other merits, the data series has not been great at predicting future market returns (see chart below5). As Dimensional states:

Plotting the level of the Consumer Sentiment Index against subsequent 12-month stock market returns shows no discernible pattern, except that stocks tend to go up more often than they go down. Out of the 226 months where the sentiment index was below the long-run average, the average equity premium over the next year was 10.6%.

The conclusion here is that bad sentiment doesn’t mean you should be scared—markets tend to price in the latest views on the economy, including the level of consumer optimism. As a side note on the election, while polls were showing the presidential race to be a toss-up, the prediction markets (PredictIt and Polymarket), were more accurately predicting the actual outcome. Markets are remarkably efficient—don’t try to outsmart them.

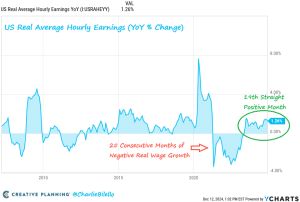

In addition, the US economy continues to be very strong. Many of the data sets continue to show strength: unemployment closed the year near its low at 4.1% and inflation is decelerating (albeit more slowly than before). There are many reasons for this, but I thought I’d highlight just two. First, as you can see from the chart6 below, we’ve had nineteen straight months of positive real earnings growth (earning growth above inflation). That has kept the consumer in good shape.

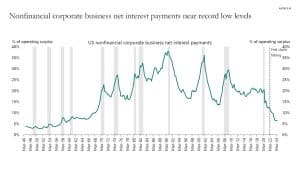

Second, rising interest rates aren’t having as big an impact as what might have been expected (except on the US Government!). Consumer mortgage loans are largely locked in at lower rates (most mortgages are 30-year fixed-rate loans). Moreover, as you can see from the chart7 below, non-financial companies’ debt service payments as a percent of operating income are at a level not seen in decades. In other words, companies are spending a smaller portion of their earnings to pay off debts than they have in many years. So, all in, things still look good.

Yes, there are risks (What about tariffs? Interest rates? Inflation?). To reiterate what we’ve said before—there are always risks. And the impacts of those risks, even if they do come to pass, aren’t always clear. Nearly everyone thought that the market could never rise like it did with interest rates rising dramatically over the last year, but it did. We don’t even know what the new administration is going to be able to execute. And even if we had a crystal ball (which we do not), we still might not get the impacts right. As Jason Zweig (who writes a very thoughtful column in “The Wall Street Journal”) recently said: “Obvious doesn’t mean inevitable.8 It’s only obvious in retrospect.”

Private Equity

I recently read an academic article9 which concluded that:

Private equity funds tend to select relatively small firms with low EBITDA multiples… Hold-to-maturity accounting of portfolio net asset value eliminates the majority of measured risk. A passive portfolio of small, low EBITDA multiple stocks with modest amounts of leverage and hold-to-maturity accounting of net asset value produces an unconditional return distribution that is highly consistent with that of the pre-fee aggregate private equity index. The passive replicating strategy represents an economically large improvement in risk- and liquidity-adjusted returns over direct allocations to private equity funds, which charge average fees of 6% per year.

While we do it without leverage, we tilt our portfolios similarly to small, cheap and profitable factors. While we don’t have the ability to avoid marking-to-market like private equity, if you focus on the long-term, performance should follow.

Short Selling

While short selling (and short sellers themselves) often get a very bad rap, I believe that they provide an important check on markets. In my experience, short sellers often do more thorough research and uncover facts not commonly known to other investors. Companies, though, often find them a nuisance, and sometimes aggressively go after the shorts.

There are very few who have been more aggressive than Overstock.com. In 201910, in an effort to cause a short squeeze, Overstock created a security (Digital Voting Series A-1 Preferred Stock) that it would dividended to all shareholders.

Because short sellers are required to pay dividends on stocks they are short, and because these securities were unavailable for them to purchase to deliver to shareholders, the shorts were forced to cover prior to the dividend date. This caused a short squeeze (the stock nearly doubled in 10 days), the CEO sold all his shares at peak (and fled the country to Indonesia).

The short sellers sued saying it was market manipulation, but a court recently ruled11 that it was legal. This makes short selling extremely risky—any company can force a short squeeze by creating a new security that the shorts can’t have prior access to. We’ll see if that ruling holds, but if it does, I imagine it will reduce short selling dramatically, which in my mind will harm markets.

With that as a backdrop, I was saddened to hear that Nate Anderson is closing his short selling research firm, Hindenburg Research12. Hindenburg focused on, and was incredibly successful at, finding and exposing corporate frauds. According to his letter, nearly 100 individuals have been charged civilly or criminally by regulators at least in part through its work, and he exposed some very high profile wrongdoing including Trevor Milton at Nikola,13 Carl Icahn, and Gautam Adani. While he didn’t mention the Overstock case as the reason why he is closing shop, I personally know other short-focused investors who are concerned about whether the ruling will severely reduce the ability to short. I hope others will take his place.

New Addition

Our SAM family is growing. We are thrilled that Adam Jonah has decided to join our team. With a background in AI and coding from his work at Tesla, Adam is driven by a passion for solving complex problems at the intersection of technology and finance. He has already hit the ground running, including developing new digital tools at breakneck speed. Stay tuned for more on this—we will have more to share in the coming months.

Interesting Stories from the Quarter

Every quarter I think will be the one where I don’t spend any time speaking about crypto. Without commenting on whether parts of crypto will endure through this period, the newness and lack of regulation still makes crypto like the old Wild West.

When President-elect Trump formally announced the creation of the “Department of Government Efficiency,” he referred to in his statement as “DOGE”14. DOGE will be co-headed by Elon Musk, who has, at various times, tweeted about a cryptocurrency of the same name (DOGE). So, when Musk tweeted a logo for the new government department DOGE with a cartoon Shiba Inu on it (the symbol of the DOGE crypto currency), Dogecoin’s value was up nearly 20%, before paring gains (including this gain, the total gain of DOGE from the election through (including this gain, the total gain of DOGE from the election through mid-November was 153% compared with bitcoin’s 30% rise in the same period). Why? People like memes, I guess.

Speaking of memes, and without getting into too much detail15,

A young woman named Haliey Welch was out for a night on the town in Nashville when she was approached for a person-on- the-street interview for someone’s YouTube/TikTok channel. She gave a funny, charming, somewhat risqué answer to one of the questions. The next day they posted the video; it went extremely viral and Welch became famous as “Hawk Tuah Girl.”

So, in today’s age, how do you monetize your newfound fame? What else—you create a crypto memecoin, give yourself most of the tokens, and then sell the rest of them to the public. Even if the coins are popular for a very brief time, you can sell a lot of them and pocket lots of money.

You don’t even have to do anything else other than go on social media and hope you can convince people that the memecoin represents that meme. If they do, then the value of the token goes up. There is no substantive connection between the coin and anything real: no ownership of intellectual property, no contracted cash flows, nothing. And yet somehow, sometimes, in today’s age, it works.

So, that’s what she did, creating the Hawk Tuah coin. Miraculously, it briefly had a value of $500 million before falling to $25 million the next day. Supposedly, “insiders” pocketed $3 million. Now Haliey is in legal trouble (as I write this, it’s unclear whether she’s going to be arrested) because “investors” (can you call them that?) are furious that insiders sold so much, and the value plummeted so quickly.

As Matt Levine writes16:

People are complaining that this is a “rug pull” or a “pump and dump,” but I cannot understand what different thing they thought would happen. The Hawk Tuah coin would build an enduring business with large and growing value for years to come? What? Why? How? It’s a memecoin representing the fastest-melting imaginable form of fame; of course, it should go to $500 million and then to zero in a day. That’s what it’s for! It worked perfectly!

Getting away from crypto for a minute, new rules are taking effect in Belgium17 which require executives and key personnel at banks to take the oath in the presence of officials from Belgium’s Financial Services and Markets Authority (and certain other staff making the pledge in front of managers):

“I commit myself to act honestly and with integrity, as well as competently and professionally, in all circumstances while performing my professional activities, taking into account the interests of clients and treating them fairly. I have taken note of the specific rules established by the King in this regard.”

We at Satovsky always acted with integrity (the I in our often-used acronym “FAMILY”) and have always strived to act in the best interests of our clients. We don’t need a new oath for that!

Here’s to a 2025 full of health, happiness and abundance—with a special shout-out to our own Christine Lucero. Thanks to all of you for your trust in our partnership.

Avi and the Satovsky team