After a very strong 2023, markets generally continued to rise in the first quarter of 2024. The S&P 500 rose just over 10%, and international markets were up 5.6%.

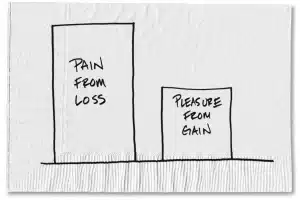

Another great mind sadly passed away this quarter. Daniel Kahneman, who, along with his often partner Amos Tversky, reinvented the way we think about behavioral economics, passed away on March 27. Kahneman and Tversky did hundreds of experiments, most extremely simple, which showed how our brains often lead us away from acting in our own best interests. One of their more famous experiments showed that for the average person, losses are twice as painful as gains are joyful (as he often does, Carl Richards simplifies it best in the drawing on the adjoining napkin1). Another experiment showed that faced with a risk that had an 80% chance of success, most would do it, but faced with a risk which has a 20% chance of failure, most would not.2 For those who haven’t read any of Kahneman’s material, I highly suggest reading his very digestible book, “Thinking Fast and Slow.”

We at SAM study behavioral economics because studies consistently show it is the single largest detractor to investor returns. Indeed, we’ve already shared with many of you that Dalbar studies over the years consistently show that investor returns are 2-5% lower than their underlying investments due to investor behavior.3 We strive to minimize those investor mistakes. And that is why, in addition to his title as founder and CEO of SAM, Jonathan uses the title “Chief Behavioral Coach.”

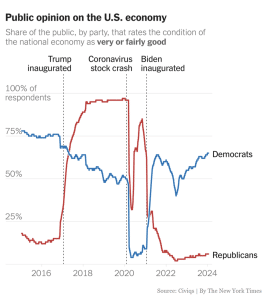

With that backdrop, let me address a question I’ve been hearing recently—what will be the impact of the election? We’ve communicated before that there is no discernable correlation between which party wins the election and stock market performance power. But many people let their politics color their view of what is happening in the economy. The chart below4 shows how Democrats and Republicans have viewed the economy over time. Note that in 2016, Republicans’ views of the economy immediately changed to the positive once Trump was elected—even before he could implement anything to help the economy! And when Biden was inaugurated, Republican views on the economy plummeted, again, even before Biden did anything. Unfortunately, Democrats are only slightly better, and reacted close to the mirror image of Republicans. Clearly, this isn’t the reality. So, whatever your politics, don’t let it get in the way of being a successful investor.

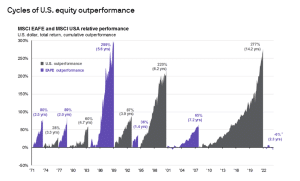

Another question we’ve heard recently is why do we own international stocks? The general argument we hear is that the US stock market has outperformed “for as long as I can remember,” and the US economy is better than other economies around the world.

Indeed, it is true that the US market has outperformed international markets for about 15 years. But as you can see from the chart below5, outperformance has been cyclical, and this is the single longest run of outperformance in over fifty years.

As Ben Carlson wrote in a recent blog post,6 there’s a lot of recency bias in how many people view international markets. I remember when Japan was the largest market in the world, when you had to invest in China, and when emerging markets—specifically the BRIC countries: Brazil, Russia, India, and China—were the place to be. Now, nobody wants to be in at least three of those.

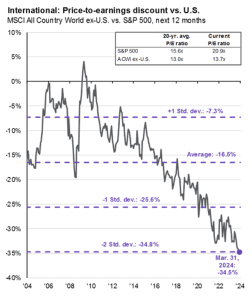

It’s also important to understand where we sit today. Valuations around the world are close to long-term averages, whereas the US is elevated relative to history. Because they have moved in opposite directions, the relative valuation is now at two standard deviations from normal. 7

The overall point is that these cycles are normal. I wouldn’t bet against America, which is why most of our clients’ equity exposure is in the U.S. I have no idea when or even if it will reverse. But I think the starting point warrants some exposure to international markets.

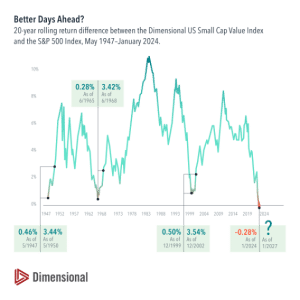

There’s a similar story with US small cap value. As shown in the chart below,8 we’ve just had the first 20-year period where the S&P has outperformed the US small cap value index. 20 years is indeed a long time to wait. But what the chart also shows is that we’ve had periods that were very close, and subsequently small cap value outperformed by a big margin. Again, we don’t know when or even if that will happen this time, but our starting point seems to skew the probability in our favor.

Past performance is no guarantee of future results. Actual returns may be lower. The Dimensional indices represent academic concepts that may be used in portfolio construction and are not available for direct investment or for use as a benchmark. Index returns are not representative of actual portfolios and do not reflect costs and fees associated with an actual investment. See “Index Descriptions” for descriptions of the Dimensional index data.

S&P data © 2024 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved.

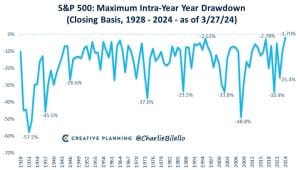

Without a doubt, the last five quarters have been terrific for the US market. Not only have the markets been up strongly, but it’s done so with very little of the volatility you normally see in the market. This can be measured in a bunch of ways, but my favorite is the one in the chart below. As Charlie Bilello states:

If the year ended today, the S&P 500’s maximum drawdown of -1.7% would be the smallest of any year in history. 1995 currently holds the full-year record with a max drawdown of -2.5%. Such low downside volatility is highly unusual – the average intra-year drawdown since 1928 is -16%.9

Regardless of whether the market continues to rise or fall, I would expect volatility to rise from here. That’s part of owning risk assets, and why we always need to mentally prepare for inevitable downturns, by thinking of equity returns over much longer periods of time (decades).

Interesting stories from the quarter

Crypto markets provide a seemingly never-ending source of material for this segment, and this quarter was no different from previous ones. A pastor and his wife, Eli and Kaitlyn Regalado, raised $3.2 million from individuals to start a crypto token called INDXcoin and a crypto exchange called Kingdom Wealth Exchange to trade it.10 A complaint against them says that it was a fraud. So far, not so unusual for crypto (unfortunately).

What’s unusual about this case is that subsequent to the complaint, the pastor posted a video message saying that the charges were true. But the issue wasn’t with him, it was with God. How did it happen?

“The Lord told us to walk away from our parking company. … [H]e took us into this cryptocurrency … well, that cryptocurrency turned out to be a scam…. And I said Lord … you told me to do this…”

“We sold a cryptocurrency with no clear exit,” he said, explaining that God told him to build it and give investors ten times the money they put in. “We did. We took God at his word.”

“One of two things have happened,” Mr. Regalado said, “One: Either I misheard God and every one of you who prayed and came in, you as well, or two: God is still not done with this project and he’s going to do a new thing.”

I doubt it, but maybe. Then it gets worse, as the complaint says:

The couple also took about $1.3 million from more than $3 million raised for the project. Regalado said about $500,000 went to the Internal Revenue Services, and a “few hundred thousand” was devoted to a home remodeling project that “the Lord told us to do.”

So, what they are saying is that God told them to raise money for crypto, and take 40% of the money for themselves, and use much of it to remodel their home. Wow, that’s chutzpah!

Lastly, some of you know that I am the proud parent of a sophomore in college and a high school senior, so I’ve now been through the “college process” twice. I was therefore fascinated by a recent story in New York Magazine11 which highlighted a college consulting company called Command Education run by a 28-year-old Yale graduate named Christopher Rim. Once he started getting clients within the NY City private schools,

… one mother gave him a reality check. As Rim recalls it, “She said, ‘Chris, if you want to make it here in New York, you cannot charge $75. No one’s going to take you seriously.’” Rim says she told him to charge $1,500 an hour and vowed to bring him more clients.

He now charges hundreds of thousands of dollars to shepherd students starting in ninth grade, curating what activities the kids do, what classes they take, etc., in order to make them more attractive to college admissions officers. He claims that at some point,

a parent at New York’s Trinity School — a $64,000-a-year Ivy League-feeder — once offered him $1.5 million if he would agree not to work with any of his child’s classmates.

Only in NY! I know that many of my kids’ classmates had paid outside college counselors (although I’d guess most paid quite a bit less than what Rim charges). I’m proud to say that neither of my kids used them, and both did amazing in the process. Now my younger one just needs to figure out which school to attend. I’ll let you know what he chooses!

Thanks to all of you for your trust in our partnership.

Avi and the SAM team