Greg Harden & Controlling the Controllables

Greg Harden & Controlling the Controllables

This week on the video blog, Jonathan pays tribute to American independence and University of Michigan’s Greg Harden while reminding us to focus on process over performance. He emphasizes the importance of controlling the controllables, and understanding that good performance is a byproduct of good planning, practice, process and persistence.

Happy July 4th weekend from the SAM Family!

Good morning. This is Jonathan Satovsky on the special 4th of July week edition of seeking wisdom, wealth and wellness. And today is a special tribute to my Michigan mentor, Greg Harden, who’s retired after 34 years as the secret weapon for the University of Michigan athletic program. Impacting thousands of student athletes and beyond.

And the concept that goes very well with the 4th of July is in our seeking freedom and independence as a country is no different than our personal pursuit of freedom and independence. And Greg’s message at the core is to control the controllables.

So, now relating it to finance a little extended version. You know, planning and process is much more important than performance. Performance will come as a byproduct of a good planning, good preparation, good practice and a good process. But you got to keep practicing.

And in finance there’s often a debate that I think is misplaced about active and passive management. And that to me creates a tremendous amount of stress. Why does someone want to be stressed about looking at who’s the fastest car this week, this month? You’re never gonna be satisfied. You’ll never be satisfied.

So, if you develop a planning process that has a persistent, profitable path for a lifetime or multiple generations of lifetimes, you can live with greater calm. And why is that important? Well, neurologically, it’s been clear that people with high stress and very anxious, all of that leads to irrational thinking and irrational decision making.

So, creating a profitable path, a persistently profitable path and a process, is like autonomous driving. If you want to go 60 miles an hour or have 60% equity exposure, the markets go up, the markets go down. You can unemotionally re-balance or re-calibrate back to your speed limit. Without the stress and anxiety of having to think you have to outsmart everyone every day, every week, every month, every year. And it’s a lot healthier way to live. Certainly is for me.

Certainly if you’re going 60 there’s gonna be people that are gonna fly by you but maybe they’ll get in an accident. Maybe they’ll crash their car or maybe they’ll get a speeding ticket. Maybe they’ll get there faster. Maybe not.

So, it’s not a debate about active or passive. I mean the first quarter of 2020, the markets dropped 20 to 30% at a fastest decline ever. You know, 16 to 19 days had a massive decline and then we’ve had this second quarter of 2020 a 20% rebound, the fastest rise since 1957. And many people who were in utter, turning on the news or the media or listening to the quacks of the voices around made a lot of irrational decisions during the first 6 months and missed out. And why do you want to miss out on a lifetime of abundance?

The world is amazing and the potential is limitless. So when your desire to seek your own celebration for the 4th of July, remember that freedom and independence is a mindset. So develop some micro habits in controlling the controllables so you too can seek your own wisdom, wealth and wellness.

Have a great day and a great holiday.

Get the Latest Wealth Insights, Delivered.

Disclosures

This blog post is not intended to be, nor should it be construed or used as, an offer to sell, or a solicitation or offer to buy any securities or interests in any strategy offered by Satovsky Asset Management, LLC (“SAM”). SAM is a registered investment advisor with the Securities and Exchange Commission – for more information see www.adviserinfo.sec.gov. Please remember that different types of investments involve varying degrees of risk, and that past performance is not indicative of future results. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the strategies recommended or undertaken by SAM) will be profitable. Market index information shown herein is included to show relative market performance for the periods indicated and not as standards of comparison. The market volatility, liquidity and other characteristics of SAM’s portfolio composition are materially different from the securities listed on public market indices. Market indata. Opinions are as of date of video and are subject to change. A copy of SAM’s current written disclosure statement discussing our advisory services and fees continues to remain available for your review upon request. SAM undertakes no duty to update information presented herein.

Further Reading

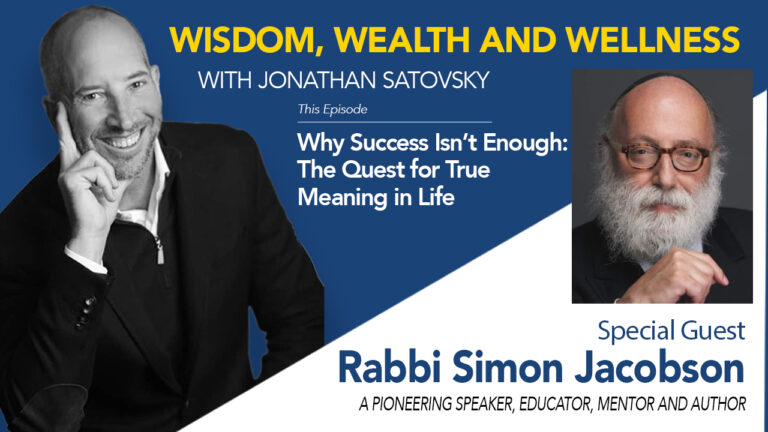

Jonathan Satovsky Interviews Rabbi Simon Jacobson

Always on the run

Learning something new