Having made it through the first Presidential debate last Wednesday – which I think we can agree was contentious, to say the least – I would like to examine another debate that many financial market prognosticators and clients alike are speculating about:

Is the financial market (S&P 500) affected by who is elected President?

There is undoubtedly a degree of uncertainty inherent in such a question; thus, as with any form of uncertainty, emotions quickly flood into the discussion and the line between fact and opinion quickly gets blurred. At SAM, we often talk about controlling the controllables, looking at facts vs. opinions, and removing the emotional veil that all too often clouds one’s judgement.

From the perspective of the facts, the answer to this big, audacious question is an unequivocal NO! To explain why, this article will examine:

- Financial returns during various presidential runs;

- Whether short-term market reaction is indicative of its long-term results;

- Why who the President is doesn’t really matter in investing;

- The importance of thinking and investing globally.

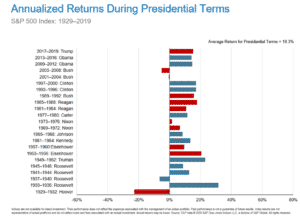

A quick history lesson on financial returns during various Presidencies

During my formative years, I admit I was much better at math & science (left brain) than I was at social studies & English (right brain), but I did very much enjoy the subject of political science (which is technically a social science, so I’ll take that to make some logical sense!).

A key characteristic of the U.S. Constitution is its well-defined system of checks and balances that divides power between three branches of the U.S. Government – Executive Branch (President), Legislative Branch (Congress), and Judicial Branch (Court system) – to ensure no one branch (or individual) can take control of the government. I think our founding fathers must have been sports fans because they clearly understood the power of team and holding one another accountable.

While our country today seems more divided than ever we are in fact a democracy, which by definition means ‘ruled by the people’. Not only does this definition assert our collective responsibility to take action for our country, it also implies the sum of the whole is a combination of its individual parts; no one person or segment of the system is inherently superior to that of the collective team (hence, the United States of America!). Interestingly enough, in its intent to diffuse concentrated power, democracy as a system also diffuses the effects of who is elected into office on financial market activity.

Let us explore this phenomenon further using historical evidence –

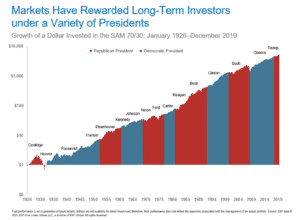

Since 1929, the S&P 500 has only seen negative returns under Herbert Hoover (1929 to 1933) during the Great Depression, and George W. Bush (2001 to 2009) during the Sept 11th, 2001 attack and the Great Recession. Interestingly, 14 individuals served as President – 7 Democrats & 7 Republicans – and the S&P 500 compounded an average of +10.3% per annum during that time, independent of who the president was, or which party they represented.

Furthermore, if we take a typical SAM 70/30 portfolio, which is comprised of both equities (US and non) and fixed income investments, the number of negatively returning Presidents drops to just one – Herbert Hoover’s term from 1929-1932.

Leading up to an election, the financial market is a voting machine…

Benjamin Graham once provided a brilliant (and topically very relevant) metaphorical framework for understanding short vs. long-term market activity that has since been widely propagated by Warren Buffet and John C. Bogle, among others:

In the short-run, the market is a voting machine, but in the long-run it is a weighing machine.

– Benjamin Graham

In effect, this statement advances that in the short-term the stock market functions like a “voting machine” – reflecting the transitory news, emotions and attitudes of the moment, whereas in the long-run functions more like a “weighing machine” – reflecting a more accurate measure of a company’s earnings or losses and thus, providing a more reliable measure of true value.

Within the political arena, we observed the truth of this statement on display during the past two Presidential transitions – Barack Obama in 2008 (Democrat), and Donald Trump in 2016 (Republican).

The day after Obama was elected in November 2008, the S&P 500 declined over 5%, which further declined nearly 25% throughout the month of November. As ABC News put it, “the business world is now bracing itself for the new reality of a Democratic-controlled Washington. That likely means stronger oversight and regulation of the financial sector, a tax structure that is less friendly to companies, increased spending on entitlement programs and more labor-friendly policies.”

Within the first few months of his Presidency many people postulated an economic landslide that would drive the US economy back into a financial crisis. In reality, the market was wrong! Over the span of Obama’s two-term Presidency (Jan 2009-Dec 2016) the S&P 500 experienced an annualized return of 14.4%, and a cumulative gain of 194% (financial data and analytics provided by FactSet).

A similar reaction occurred when Trump was elected in November 2016; again, the full effect of “voting machine” behavior was evident in the market. The day after the election, markets were halted in pre-market trading down 5%. A top hedge fund even called for an immediate 10% decline yet, as some might recall, the market actually finished up +1.1% the day after he was elected! To date under Trump’s Presidency, the S&P 500 has experienced an annualized return of 13.6%, and a cumulative gain of 62%.

So, why then, despite the emotional anticipation of unfavorable market activity as a result of the election does the S&P 500 inevitably seem to thrive?

Power of the People

Part of the answer lies in the mindset we coach our clients towards: Owning a “stock” means you actually own a tangible business. And who shows up every day to make those businesses run profitably? Individual people. And what do the vast majority of people do each and every day? They show up to make each day better than the last!

As Adam Smith, a revered father of economics, suggested centuries ago – the fundamental nature of economics must be considered by looking at human nature, which is inevitably always trying to improve itself.

Whether it is a democratic or republican policy that assumes power in November, individuals and businesses will recalibrate to protect their livelihood and those of their families, and naturally orient towards positive evolution either way.

Think globally, act locally, invest wisely

Another facet here is the global nature of many businesses and investor portfolios.

Though this may come as a surprise to some, the US is actually a minority market for many of the most iconic American businesses. For example, McDonald’s, Coca-Cola, and Apple derive only 37%, 38%, and 39% (respectively) of their last twelve-month revenues from the US. In fact, only 60% of S&P 500 business revenue is derived in the US.

From the perspective of the global (non-local) market, as measured by the MSCI All Country World Index, only 42% of listed business revenue is derived from the US.

Though a company may be domiciled and listed on a US stock exchange, the fact of the matter is, the businesses themselves are global in nature. Thus, while we have a tendency to be “home bias” in thinking that local (USA) political activity will have a significant effect on market, or “stock” performance, we too need to expand our thinking more globally.

In short, if we examine the long-term facts of businesses vs. the short-term sentiment of prognosticators it further goes to show that worrying about the US election is fairly meaningless.

Why, then, if the data shows that who is elected has no relevant effect on financial market performance do people still get so wound up in all the hype? This boils down to humans’ innate tendency to fall victim to their own emotions and subjective near-sightedness. I provided some tips for minding the Behavior Gap in another post – perhaps worth a quick read during these particularly heated times.

So, Yea or Nay?

who wins the US Presidential election does not matter to your financial investment portfolio in the long-run.

Yea – do exercise your right and responsibility to vote!

Hopefully we have clarified here that market performance is insignificantly correlated to who leads our great nation, however the above is not meant to discourage anyone from being invested in the future of the nation.

Nay – do not allow the election season or who eventually wins to affect how you go about building wealth for your long-term future. The facts show there is no debate – who wins the US Presidential election does not matter to your financial investment portfolio in the long-run.

At SAM our dedicated team of professionals consider it our fiduciary duty to provide clients with the highest standard of care and service in the advisory world. To learn more about how we may help you, get in touch with a SAM advisor today.