The foundation of our approach is always academic-based research and pure mathematics, but every client comes to us with a unique set of circumstances. There is no absolute correct path for all, but there is likely a correct path for each individual.

Whether your goal is for financial independence, to pay for a child’s college education, or to create and maintain multi-generational wealth, we look at your financial life holistically to bring your principles, lifestyle and financial aspirations into harmony.

Crafting your financial journey starts with getting to know who you are and what you strive for. Our team of Certified Financial Planner™ and Chartered Financial Analyst® professionals review your total financial picture and draw on more than 50 years of combined experience to structure a comprehensive financial strategy that serves your long-term aspirations.

The basis for any successful financial plan begins with a properly structured Balance Sheet and strong Cash Flow. Here we assess your assets and liabilities, debt utilization and lifestyle expenses to determine your need, ability and willingness to own equity assets.

Your financial obligations should be the last thing on your mind in the event of an unexpected circumstance. We review all your insurance policies such as life, disability and long-term care to ensure your family is properly protected, and help you secure adequate coverage, if advisable.

From foundational estate planning to intricate planning needs, our advisors work closely with our estate planning specialists to help you prepare for all life scenarios. Proper estate planning involves ongoing review to maximize the distribution of assets while minimizing estate tax liabilities.

A comprehensive approach to retirement planning that focuses on spending rates and establishing an appropriate structure to facilitate accumulation before retirement, and maximum distribution during retirement.

Investors often focus on investment returns and overlook the benefits of tax planning as a means of maximizing financial assets. We take a long-term approach to tax planning, both in the accumulation and distribution of assets, in order to minimize tax liabilities over a lifetime.

Our investment planning process focuses on long-term, goal-oriented, holistic solutions. We specialize in structuring sustainable portfolios in an ever-changing economic landscape, planning and caring for your assets as if they were our own.

Guided by the principles of Warren Buffett and Jack Bogle, our investment philosophy emphasizes owning high-quality assets for decades, not days, while seeking downside protection and controlling the drag of cost and taxes.

We actively research and invest in assets that exhibit certain quantifiable characteristics that have been demonstrated, through evidence, to deliver more favorable long-term risk-adjusted returns — not every time, but over time.

We create tailored solutions with the highest probability of success that’s unique to your strategic financial path. Our goal is to build a sustainable portfolio that enables you to stay the course and maintain long-term peace of mind.

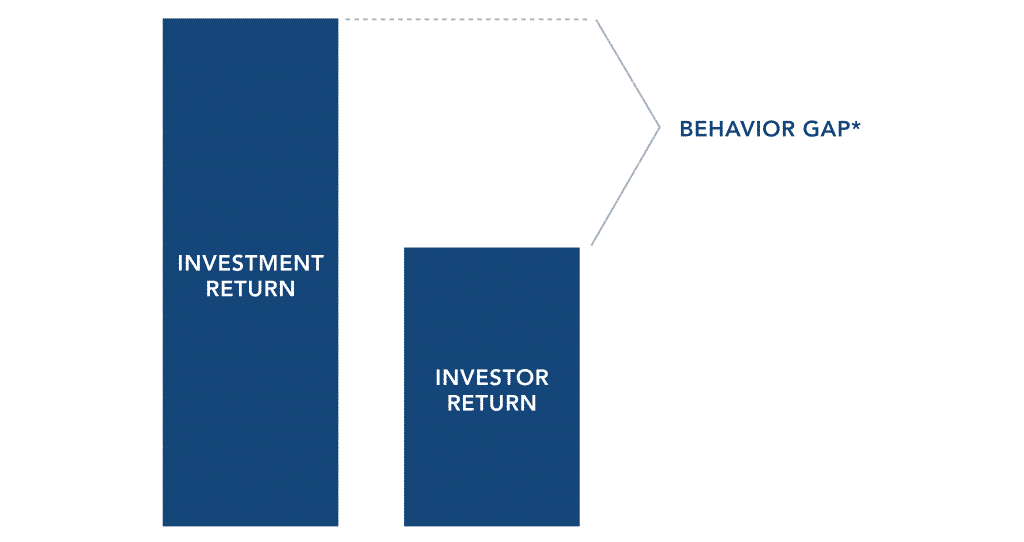

*Various estimates place the drag from poor decision making anywhere from 1.17% to 6.5% annually. Working with a trusted advisor to minimize unhealthy behavior leads to more-informed investment decisions and, subsequently, better long-term investment returns.

Humans have the tendency to allow emotions to play a role in investment decision making, which often leads to a disruption in their long-term financial ambitions. This phenomenon, coined by Carl Richards as The Behavior Gap, describes the difference between the higher returns an investor could potentially earn, and the lower returns they actually earn as a result of their own behavior.

Healthy long-term rewards are reflective of investor behavior and the ability to remain calm during times of temptation and uncertainty; something we refer to as practicing financial mindfulness. We provide ongoing education and behavioral coaching to help you develop healthy habits and understand the impact of emotional, short-term thinking as part of our ongoing concierge support.

We work with some of the industry’s leading technology platforms to improve performance, automate processes, and minimize stress all while providing clients a better user experience.

© 2024 SATOVSKY ASSET MANAGEMENT | PRIVACY POLICY | FORM CRS | TERMS OF USE/DISCLAIMERS

NOT FDIC INSURED. NOT BANK GUARANTEED | MAY LOSE VALUE, INCLUDING LOSS OF PRINCIPAL | NOT INSURED BY ANY STATE OR FEDERAL AGENCY

Join Jonathan and his guests as they discuss how to overcome the behavioral biases and blind spots that hold us back.

New episodes drop every other Tuesday on your favorite streaming platform.